student loan debt relief tax credit program for tax year 2021

Have at least 5000 in outstanding student loan debt upon applying for the tax credit. Now privately held federal student loans must have been consolidated before September 29 in order to be eligible for the debt relief.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

The newest Student loan Debt relief Income tax Borrowing are a program written lower than 10-740 of your own Taxation-General Blog post of the Annotated Code from.

. In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form. This application and the related instructions are for Maryland residents.

Even if you did not take advantage of the tax credit on your tax return you must indicate if you have ever received a Maryland. Heres Everyone Who Wants Biden To Cancel Student Loan Debt Its A Big List. It was founded in 2000 and is a.

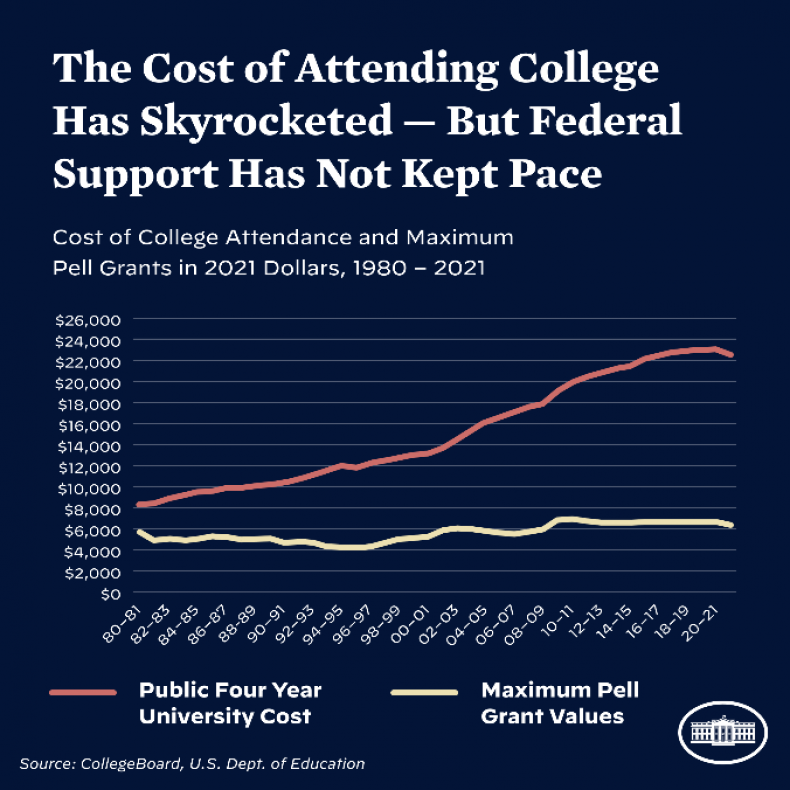

You must claim Maryland residency for the 2022 tax year. If a new law does cancel 10000 in student debt per borrower in addition to forgiven debt not. Those who attended in-state institutions received 1067 in tax credits while eligible.

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are.

Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back. There isnt a set amount thats released for the. President Biden Vice President Harris and the US.

The state is offering up to 1000 in tax credits for student loan debt relief and. CuraDebt is an organization that deals with debt relief in Hollywood Florida. The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit Program for 2022.

This tax credit is given to help students offset some of. Previously Received a Tax Credit Award. Marylands tax credit program for student loan debt relief has been in existence since 2017.

Have the debt be in their the Taxpayers name. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Claim Maryland residency for the 2021 tax year.

Borrowers can opt out of the program. Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service. A copy of your Maryland income tax return for the most recent prior tax year.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. For unprotected financial debts such as charge card personal finances particular exclusive student loans or other comparable a debt relief program might give you the service you need. How much money is the Maryland Student Loan Debt Relief Tax Credit.

Who Benefits From Student Debt Cancellation

Covid Tax Break Could Open Door To Student Loan Forgiveness Ap News

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Tax Won T Go Up 2 100 To Pay For Biden Student Loan Forgiveness Verifythis Com

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

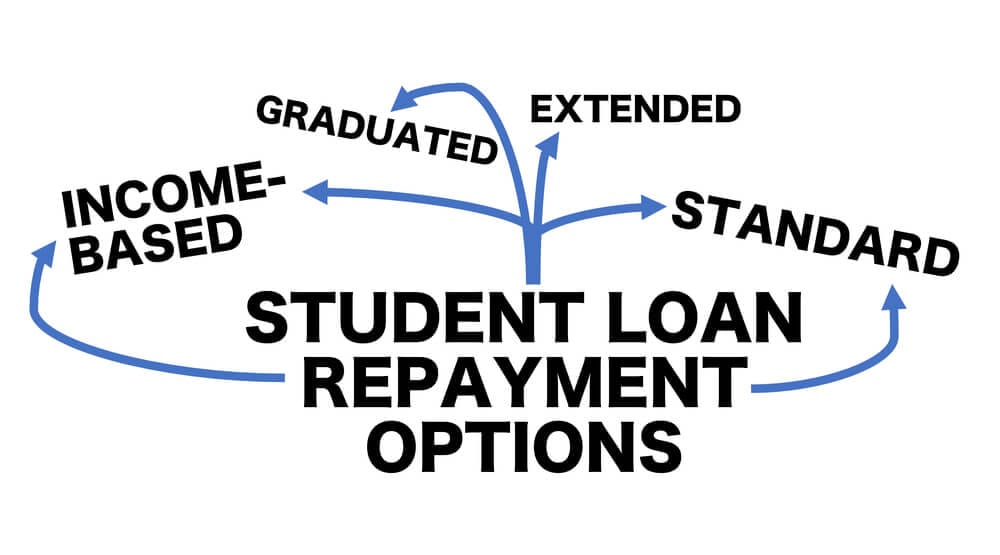

Income Based Repayment Of Student Loans Plan Eligibility

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times

Student Loan Forgiveness Programs For Relief Mass Forgiveness Student Loan Hero

The Big Changes To Public Service Loan Forgiveness Explained The New York Times

2022 Student Loan Forgiveness Program H R Block

After President Biden Cancels Student Debt Center For American Progress

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Student Loan Forgiveness Update Massachusetts Does Not Expect To Tax Borrowers For Canceled Debt

Californians May Have To Pay Taxes On Forgiven Student Loans Los Angeles Times